Date: 9 October 2020 (Friday)

Time: 12:30 - 14:00 (Hong Kong Time)

Platform: Zoom

* The Forum was conducted in English

| 12:30 – 12:35 |

Welcoming remarks Dr Xu Xin |

| 12:35 – 13:15 |

Presentation on "The Promises and Pitfalls of WealthTech: Evidence from Online Marketplace Lending" Prof. Haitian Lu |

| 13:15 – 13:40 |

Panel Discussion Panelists: Ms Michelle Li Mr Jack Poon Moderator: |

| 13:40 – 14:00 | Q&A Session |

|

Organizers: |

| Welcoming Remarks | |

|

Dr Xu Xin |

| Presentation on "The Promises and Pitfalls of WealthTech: Evidence from Online Marketplace Lending" | |

|

Prof. Haitian Lu |

| Panel Discussion | |

|

Ms Bénédicte Nolens Head of BIS Innovation Hub Hong Kong Centre Bank for International Settlements – BIS |

|

Ms Michelle Li CEO, AMTD Digital |

|

Mr Jack Poon Professor of Practice, Faculty of Business The Hong Kong Polytechnic University |

|

Moderator: Dr Steven Wei Deputy Director, AMTD FinTech Centre of PolyU Faculty of Business Associate Professor, Faculty of Business The Hong Kong Polytechnic University |

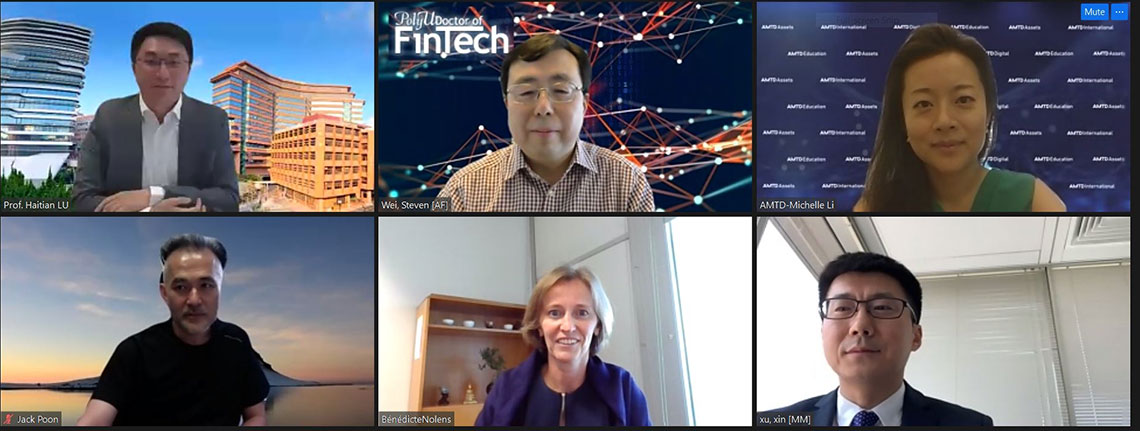

The online Knowledge Transfer Forum held on 9 October 2020, jointly organized by the Faculty of Business of The Hong Kong Polytechnic University (PolyU) and its AMTD FinTech Centre and Digital Transformation Centre, brought Professor Haitian Lu, Director of Chinese Mainland Affairs Office and Professor in Law and Finance in the Faculty, to share his latest research on the frontier research topic of the development of financial technology on WealthTech, and its impact on consumer welfare and financial markets.

The opening speech was delivered by Dr Xu Xin, Associate Dean of External Relations and Development of the Faculty of Business and Director of Digital Transformation Centre.

Professor Haitian Lu firstly sketched the definitions of ultra-rich and shared his friends' real answers of private banking special services as well as expected rate of return. For decades, the conventional wealth management industry stayed in its comfort zone, charging high fees for providing advice to a small group of high-net-worth clients. The rise of WealthTech, that aims to enhance the wealth-management process, has changed this landscape.

Professor Haitian Lu firstly sketched the definitions of ultra-rich and shared his friends' real answers of private banking special services as well as expected rate of return. For decades, the conventional wealth management industry stayed in its comfort zone, charging high fees for providing advice to a small group of high-net-worth clients. The rise of WealthTech, that aims to enhance the wealth-management process, has changed this landscape.

"WealthTech, which democratizes the financial services, includes promises of serving the underserved market segments with affordable, accessible, instant, and transparent wealth management services," said Professor Lu. With a briefing of WealthTech business model, he also explained WealthTech's particular popularity in the Asia region.

Professor Lu then emphasized the key part of his presentation, the evidence from Online Marketplace Lending. After comparing traditional and new models of OML as well as WealthTech bidding and manual bidding, he came up with the hypotheses and empirical findings. As for the takeaway for human investors, the findings suggested human investors should choose WealthTech but they will face a dilemma with rising WealthTech: the choice between paying commission for less effective service from WealthTech or bearing greater losses of being cream-skimmed by WealthTech if DIY. The presentation ended up with WealthTech implication to regulators.

Following Professor Lu's presentation was a panel discussion among Ms Bénédicte Nolens, Head of BIS Innovation Hub Centre in Hong Kong; Ms Michelle Li, CEO of AMTD Digital; and Mr Jack Poon, Professor of Practice of The Hong Kong Polytechnic University.

During the panel discussion, Ms Michelle Li elaborated on the ecosystem built by AMTD digital channel which is a bundling of financial and non-financial offerings for SMEs and consumers.

The discussion was moderated by Dr Steven Wei, Deputy Director of AMTD FinTech Centre of PolyU Faculty of Business. Although the discussion was carried out remotely, guests shared their views and insightful ideas with participants.