Safer, Smarter and More Transparent: The Next Generation of Stablecoins

Other Articles

How a New Dual-Class Design Could Make Digital Currencies Truly Stable

Study conducted by Prof. Min DAI and his research team

Over the past decade, the cryptocurrency market has experienced explosive growth, evolving from a niche innovation into a global financial phenomenon. Thousands of digital assets are now traded worldwide, driving unprecedented advancements in blockchain technology and decentralised finance. However, the prices of cryptocurrencies remain highly volatile, limiting their effectiveness as reliable means of payment or stores of value. In response, stablecoins have rapidly emerged as a crucial solution, offering price stability and fostering broader adoption within the digital economy.

By using the option pricing theory and the Ethereum (ETH) platform that allows the running of smart contracts, the team of Prof. Min DAI, Chair Professor in Applied Statistics and Financial Mathematics of the Department of Applied Mathematics and the School of Accounting and Finance at The Hong Kong Polytechnic University, has spearheaded a pioneering study on the design of fixed-income-like stablecoins. Published in Mathematical Finance [1], this research integrates rigorous mathematical modelling with economic theory to address the challenge of achieving price stability in decentralised currencies.

Broadly, stablecoins can be categorised into two main types. The first type, exemplified by USDT and USDC, is fiat-collateralised. These coins are backed 1:1 by fiat currency reserves held by centralised institutions. While this structure is straightforward and offers users a familiar value reference, it raises significant concerns regarding trust and transparency—users must rely on the issuer’s claims about the adequacy and security of the reserves, which are often difficult to verify in real time.

The second major category is crypto-collateralised stablecoins, with DAI being the most prominent example. These stablecoins are backed by excess collateral in the form of cryptocurrencies and are governed by smart contracts, which automatically manage issuance, redemption and liquidation processes. This approach offers a high degree of transparency and decentralisation, as all transactions and collateral levels are visible on-chain. However, it suffers from low capital efficiency due to the requirement for significant over-collateralisation. It remains exposed to systemic risks during periods of extreme market volatility when rapid declines in collateral value can trigger mass liquidations and destabilise the peg. Recent years have also seen the emergence of innovative stablecoin designs such as USDe, which utilise perpetual futures and dynamic hedging mechanisms to maintain price stability.

While these models promise improved capital efficiency and flexibility, their long-term stability is highly dependent on the robustness of their hedging strategies and the prevailing market conditions, introducing new layers of risk that must be carefully managed.

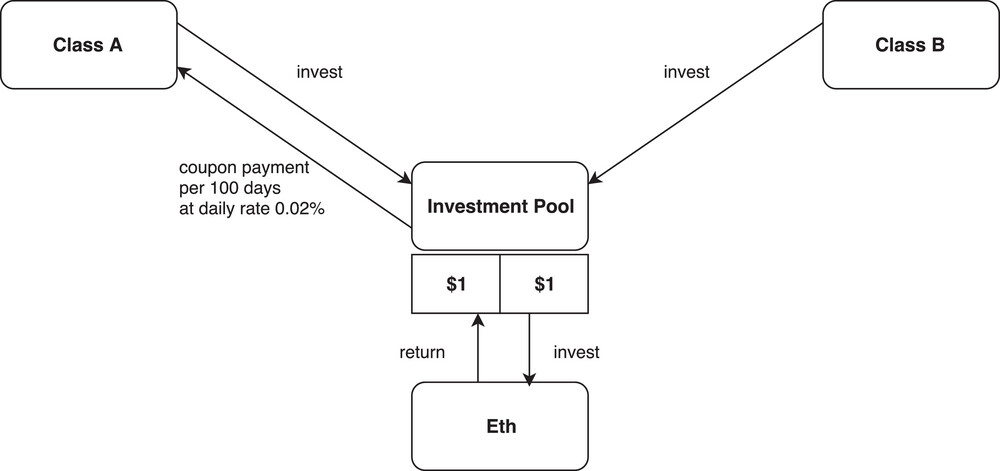

To tackle these challenges, Prof. Dai's research team has proposed a novel stablecoin architecture inspired by option pricing theory and implemented via smart contracts. The core innovation lies in a dual-class structure combined with automated upward and downward reset mechanisms. More precisely, this scheme leverages smart contracts to split the collateral pool into senior (Class A, fixed income-like) and junior (Class B, leveraged) tranches (Figure 1), thereby achieving risk stratification and transferring market risk to B-class investors with higher risk appetite. This structure not only enhances capital efficiency by allowing more flexible use of collateral, but also enables dynamic risk allocation through automated upward and downward reset mechanisms. Furthermore, Class A can be further split into A' (ultra-stable) and B' (subordinate risk) tokens, creating a multi-layered hierarchy of risk and return. This flexible tranching framework allows holders to enjoy stable yields while speculative investors can pursue higher returns, all governed transparently by smart contracts.

Figure 1. Classes A and B, initial split. At time t, one share of Classes A and B each invests $1 in ETH. The initial ETH price is P = $500, and the prevailing conversion factor β = 1. So, two shares of ETH exchange for 500 shares of Class A coins and 500 shares of Class B coins.

The upward and downward reset mechanisms are designed to dynamically manage risk and maintain stability within the dual-class structure. An upward reset is triggered when the value of the leveraged (Class B) tranche exceeds a preset threshold, distributing profits and resetting leverage. A downward reset occurs when Class B's value falls below a lower bound, partially liquidating positions to protect the senior (Class A) tranche and restore system balance. These automated resets help isolate risk, enhance resilience, and ensure the stablecoin's value remains robust even during extreme market movements.

The split structure of Prof. Dai's design resembles Collateralised Loan Obligations (CLOs) and the over-collateralisation test (O/C test) for CLOs, where Classes A and B resemble the senior and equity tranche, respectively. However, this structure contributes to the securitisation literature by proposing a much safer way to conduct over-collateralisation for CLOs via the downward reset mechanism and by incorporating the over-collateralisation mechanism directly into the valuation of tranches, resulting in a periodic partial differential equation (PDE) rather than the standard Black-Scholes PDE.

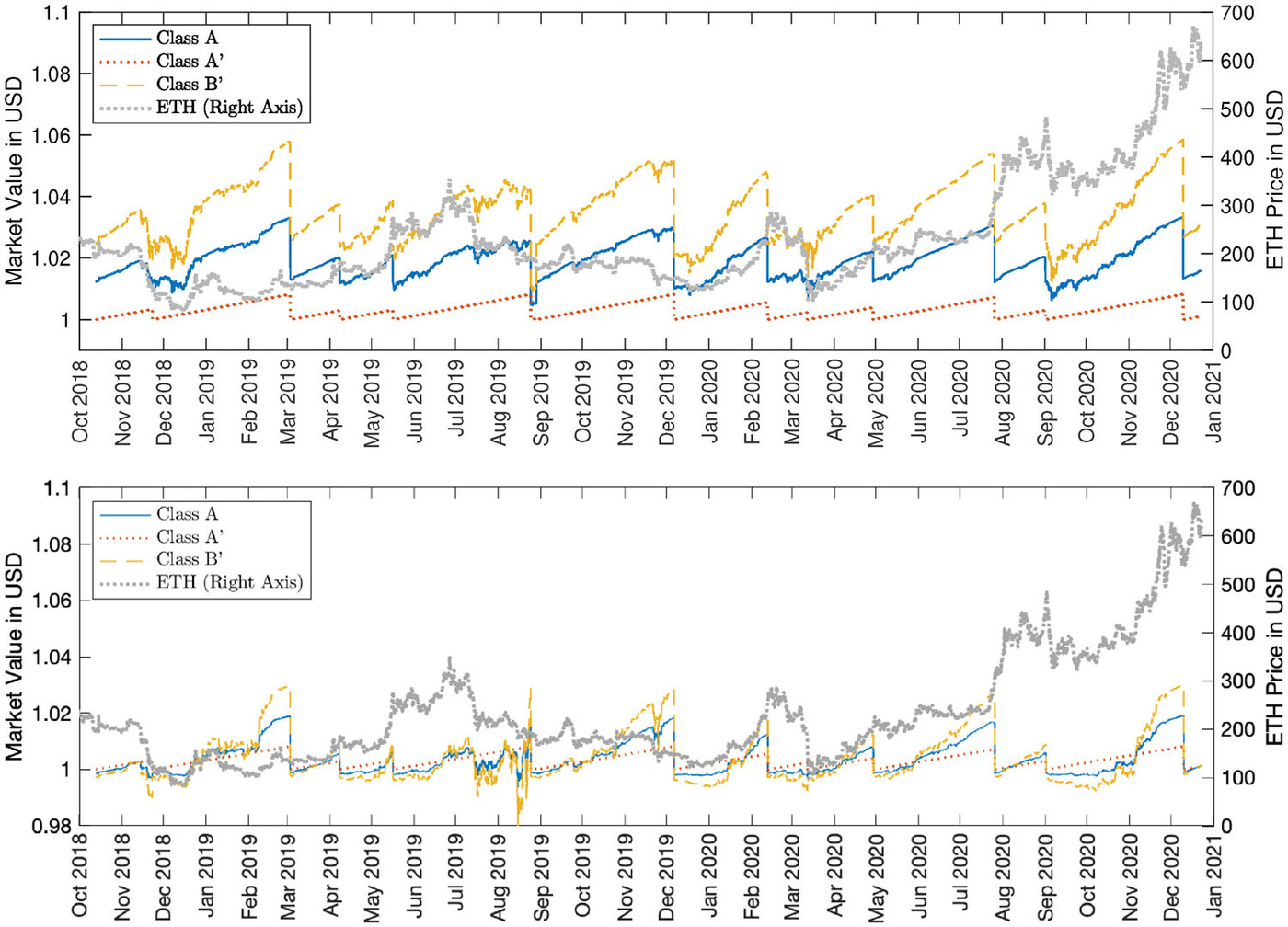

Figure 2. Market value of Classes A' and B' per share in USD, compared with Class A. Top: design without subsidy; Bottom: design with subsidy. Value calculated with estimated volatility 𝜎 = 123% p.a. Annualised market value volatility of Class A' and B' is 1.37% and 5.70%, respectively.

The numerical tests demonstrate the performance of the proposed dual-class design using historical ETH price data. Results show that Class A' tokens maintain exceptionally low volatility, even under high market turbulence and jump risks, closely tracking the US dollar (Figure 2). The analysis confirms that the dual-class structure and reset mechanisms provide strong stability and resilience, outperforming traditional stablecoins like DAI, especially during extreme market events.

How does this new design compare to existing stablecoin models?

- Transparency: Like DAI, the dual-class model allows all collateral and Net Asset Values (NAVs) to be verified on-chain in real time, improving on the 'black box' nature of fiat-backed coins.

- Capital Efficiency: Unlike DAI, which requires significant over-collateralisation, the dual-class system enables all tranches to be freely traded, improving capital utilisation.

- Risk Segregation: Speculative risk is concentrated in B/B' tranches, while A/A' holders are shielded from most volatility and receive stable interest payments.

- Regulatory Friendliness: Automated, auditable smart contracts facilitate real-time oversight and risk assessment by regulators.

In conclusion, the dual-class structure presents a compelling and forward-thinking framework for achieving price stability in the highly volatile cryptocurrency landscape. By integrating risk tranching, automated upward and downward resets, and smart contract-based governance, this system not only isolates market risk but also significantly improves capital efficiency. The design enables differentiated exposure for investors, allowing conservative participants to enjoy fixed-income-like returns while risk-tolerant users pursue leveraged gains. This innovative architecture addresses key shortcomings of traditional stablecoins, such as their opacity and rigidity, and offers a scalable, transparent and decentralised solution that aligns with the evolving needs of modern financial ecosystems.

Prof. Dai is currently the elective Chair of INFORMS Finance Section, a co-editor of Digital Finance and serves on the editorial boards of academic journals including Operations Research, Finances and Stochastics, Journal of Economic Dynamics and Control, and SIAM Journal on Financial Mathematics. He has been invited to present at many conferences and workshops. Notably, he was a plenary speaker at the 12th World Congress of Bachelier Finance Society.

| References |

|---|

[1] Cao, Y., Dai, M., Kou, S., Li, L., & Yang, C. (2025). Designing stablecoins. Mathematical Finance, 35, 263–294. https://doi.org/10.1111/mafi.12445.

| Prof. Min DAI and School of Accounting and Finance |