FinTech's Green Revolution: How Digital Innovation Is Transforming Green Bond Issuance

Other Articles

Exploring the Catalytic Role of Financial Technology in Expanding Sustainable Finance in China

Study conducted by Prof. Jimmy Yong JIN and his research team

Financial technology, or FinTech, has rapidly become an integral part of daily life, reshaping the way individuals and institutions interact with financial services. From mobile payments and digital banking to blockchain-based solutions, FinTech's reach now extends far beyond traditional banking, permeating sectors as diverse as insurance, investment and lending. As these technologies continue to evolve, their influence on financial markets grows ever more profound, raising important questions about their potential to address some of the world’s most pressing challenges—chief among them, climate change and environmental sustainability.

One area where FinTech's transformative power is increasingly evident is in the issuance of green bonds. Green bonds, a relatively recent innovation in sustainable finance, are fixed-income securities whose proceeds are earmarked for projects with positive environmental impacts, such as those in renewable energy, pollution reduction and climate adaptation. The global green bond market has witnessed exponential growth, with issuance volumes surpassing half a trillion US dollars in 2021. Yet, despite this impressive expansion, the market remains constrained by several persistent challenges: complex issuance procedures, difficulties in verifying and evaluating underlying projects, and regulatory uncertainties. These obstacles have limited the supply of green bonds, impeding progress towards a carbon-neutral future.

Against this backdrop, the question arises: can FinTech help unlock the latent potential of green bonds and accelerate their adoption? In a recent study published in the Journal of International Financial Markets, Institutions and Money [1], Prof. Jimmy Yong JIN, Assistant Dean (Fund-raising and Development) of the Faculty of Business and Professor of the Department of Logistics and Maritime Studies at The Hong Kong Polytechnic University, and his research team seek to answer this question by examining the impact of regional FinTech development on green bond issuance in China—a country at the forefront of both FinTech innovation and green finance.

The motivation for this research stems from a notable gap in the existing literature. While previous studies have explored the determinants of green bond issuance, they have largely focused on firm-level attributes or issuer motivations, with scant attention paid to regional factors such as technological infrastructure. Yet, regional characteristics can play a decisive role in shaping financial markets, particularly in a country as vast and diverse as China.

China's Unique Position in FinTech and Green Finance

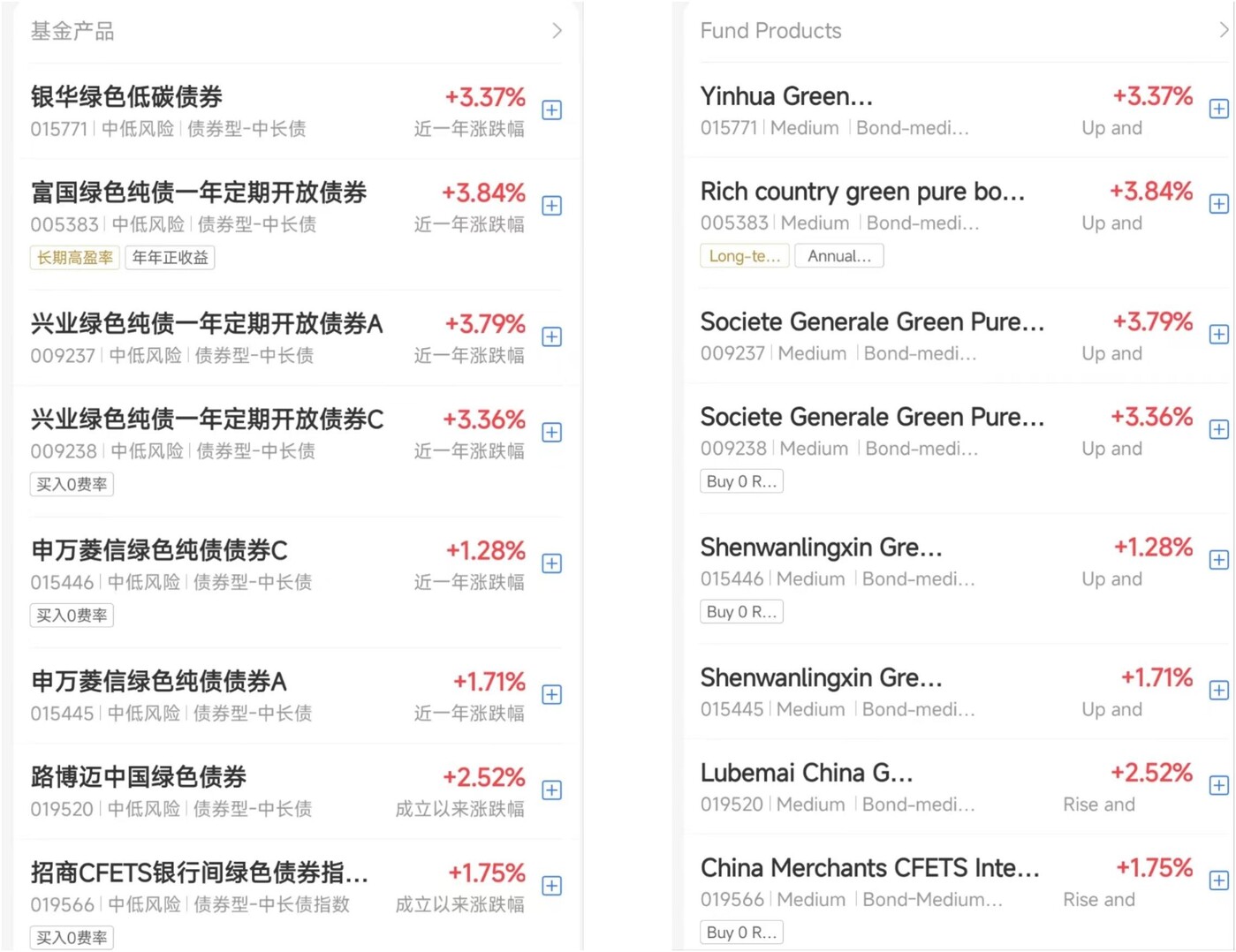

China presents a unique context for this investigation. Not only is it a global leader in FinTech adoption, with platforms like Alipay (Figure 1) and WeChat Pay revolutionising payments and financial services, but it is also a major player in the green bond market, accounting for a significant share of global issuance. The country’s ambitious sustainability targets and rapid urbanisation make it an ideal laboratory for studying the interplay between digital innovation and green finance.

Figure 1. Examples of green bond products in Alipay.

This research is guided by two central questions: 1. What is the effect of FinTech development on green bond issuance? 2. Through which channels does FinTech exert its influence, on the supply side, by empowering financial intermediaries, or on the demand side, by raising environmental awareness?

By addressing these questions, this study aims to shed light on the mechanisms through which FinTech can catalyse sustainable finance, offering insights that are both academically significant and practically relevant for policymakers, investors and financial institutions.

Drawing on novel city-level data from China, the research employs robust econometric techniques, including ordinary least squares (OLS) regression, instrumental variable (IV) analysis and difference-in-difference (DiD) models, to establish a causal relationship between FinTech development and green bond issuance. The results are striking: regions with higher levels of FinTech adoption consistently exhibit greater volumes of green bond issuance, even after controlling for a range of bond-level and city-level factors.

A one-standard-deviation increase in the FinTech index is associated with a substantial rise in green bond issuance, which is equivalent to approximately 98 million US dollars. This effect remains robust across various model specifications, including those that account for potential endogeneity and selection bias.

How FinTech Drives Green Bond Issuance

Examining the underlying mechanisms more deeply, the study identifies two principal channels through which FinTech promotes green bond issuance:

1. Empowering Financial Intermediaries

FinTech enhances the efficiency, transparency and speed of green bond issuance by digitising and automating processes traditionally bogged down by paperwork and manual intervention. Technologies such as blockchain and smart contracts facilitate secure, immutable record-keeping and streamline compliance checks, reducing transaction costs and mitigating risks of fraud. Digital platforms also enable intermediaries, such as banks, investment firms and insurance companies, to reach a broader pool of investors, disseminate information more effectively and match green projects with suitable financiers.

2. Increasing Environmental Awareness

On the demand side, FinTech platforms play a pivotal role in raising environmental consciousness among investors and the wider public. User-friendly interfaces, educational resources and gamified applications, such as Ant Forest, encourage individuals to track and reduce their carbon footprint, fostering a culture of sustainability. Enhanced environmental awareness translates into greater demand for green financial products, including green bonds, thereby expanding the investor base and mobilising additional capital for climate-friendly initiatives.

The research also uncovers important heterogeneities in the FinTech-green bond nexus. The positive impact of FinTech is especially pronounced for bonds without high credit ratings, whose proceeds are directed towards new projects rather than refinancing. Non-state-owned issuers, cities connected to China’s High-Speed Railway network and those located in the eastern region, where FinTech adoption is most advanced, benefit disproportionately from digital innovation. These findings suggest that FinTech not only facilitates green bond issuance in general, but also helps overcome specific barriers faced by less established issuers and regions.

FinTech's Impact Across Sectors

The implications of these findings are far-reaching. For academia, the study enriches the literature on both FinTech and green finance, highlighting the importance of regional technological infrastructure in shaping market outcomes. It demonstrates that FinTech is not merely a tool for enhancing efficiency in traditional financial markets but a powerful enabler of sustainable investment, capable of bridging information gaps, reducing transaction costs and fostering trust among stakeholders.

For policymakers and regulators, the message is clear: promoting FinTech development can yield significant dividends in the pursuit of environmental goals. Regulatory frameworks should be adapted to support the integration of digital technologies into green finance, with particular attention paid to the role of financial intermediaries. Legislation and supervisory practices must evolve to accommodate new forms of market mediation, ensuring that transparency, security and investor protection are maintained as FinTech platforms proliferate.

Policymakers may also consider targeted interventions to promote FinTech adoption in regions and sectors where its impact is likely to be greatest. For example, supporting digital infrastructure in less developed areas, facilitating collaboration between the IT and financial sectors and incentivising innovation in green finance can help unlock new sources of capital for sustainable projects. The experience of cities connected to the High-Speed Railway network underscores the importance of physical connectivity in enabling digital collaboration and knowledge sharing.

For investors, the rise of FinTech offers unprecedented opportunities to participate in the green bond market. Enhanced transparency, improved access to information and streamlined investment processes make it easier for individuals and institutions to align their portfolios with environmental objectives. Investors should leverage the tools and resources provided by FinTech platforms to assess the credibility and impact of green bonds, ensuring that their investments contribute meaningfully to sustainability.

Financial intermediaries, meanwhile, should recognise the value of FinTech as a means of bridging the gap between issuers and investors. By embracing digital solutions, intermediaries can expand their reach, improve service quality and facilitate the flow of capital towards green projects. The development of cloud-based document management systems, digital identity verification and data analytics capabilities can further enhance the efficiency and integrity of green bond issuance.

This research provides compelling evidence that FinTech is a powerful catalyst for green bond issuance, offering solutions to longstanding challenges in sustainable finance. By empowering financial intermediaries and raising environmental awareness, digital innovation can accelerate the transition to a greener, more resilient economy. As China’s experience demonstrates, the integration of FinTech into green finance holds immense promise, not only for expanding the supply of green bonds but also for mobilising the capital needed to address the global climate crisis.

Prof. Jin received AIS Early Career Award from the Association for Information Systems in 2022, the Morgan Stanley Prize for Excellence in Financial Markets in 2016, and the Gold Award in China "Internet+" Innovation and Entrepreneurship Competition in 2024. He has also secured more than HKD50 million in research fundings.

| References |

|---|

[1] Huang, J., Liu, R., Wang, W., Wang, Z., Wang, C., & Jin, Y. J. (2024). Unleashing Fintech’s potential: A catalyst for green bonds issuance, Journal of International Financial Markets, Institutions and Money, Volume 93, 2024, 102009, ISSN 1042-4431, https://doi.org/10.1016/j.intfin.2024.102009.

| Prof. Jimmy Yong JIN Assistant Dean (Fund-raising and Development), Faculty of Business |