From Hostility to Embrace: The European Central Bank’s Evolving Regulatory Stance on Cryptocurrencies

Other Articles

Tracing the Shift from Neutralisation to Cooptation in the ECB's Approach to Digital Assets

Study conducted by Prof. Anson Cheuk Ho AU

The rapid rise of cryptocurrencies over the past decade has posed profound challenges and opportunities for central banks worldwide. Nowhere is this more evident than in the European Union, where the European Central Bank (ECB) has had to navigate the delicate balance between safeguarding monetary sovereignty and responding to the growing public and market interest in digital assets.

A recent research article by Prof. Anson Cheuk Ho AU, Assistant Professor of the Department of Applied Social Sciences at The Hong Kong Polytechnic University, published in Policy & Internet [1], offers a comprehensive analysis of how the ECB's regulatory posture has transformed in response to both internal macroeconomic pressures and global financial developments. By triangulating content analysis of ECB policy statements, macroeconomic data and Bitcoin price dynamics from 2014 to 2025, the study elucidates the ECB’s journey from a stance of neutralisation to one of cooptation—two distinct regulatory states that have inadvertently facilitated cryptocurrency adoption in Europe.

The background to this research is rooted in the extraordinary rise of cryptocurrencies as financial instruments and the concomitant regulatory dilemmas they have engendered. Bitcoin, the archetypal cryptocurrency, reached a market capitalisation exceeding USD1.7 trillion by October 2024, rivalling that of the largest technology firms globally. Yet, this meteoric growth has not been without turbulence. The collapse of FTX in November 2022, which resulted in an $8 billion shortfall and reverberated through 130 affiliated companies, served as a stark reminder of the risks posed by unregulated digital asset markets [2]. The event, described as a "Lehman moment" by US Treasury Secretary Janet Yellen [3], catalysed calls for greater oversight and highlighted the dangers of cryptocurrencies as speculative investments and vehicles for illicit finance.

Despite these high-profile failures, the evolution of central banks' regulatory stances towards cryptocurrencies remains underexplored. The ECB, as the monetary authority for the Eurozone, has been at the forefront of this regulatory journey. The study seeks to answer a critical question: How has the ECB's regulatory stance towards cryptocurrencies transformed over time, and what are the implications for monetary sovereignty and legitimacy?

Through a meticulous content analysis of ECB policy statements, macroeconomic indicators and Bitcoin price dynamics, the study identifies two pivotal phases in the ECB’s approach: neutralisation (2018–2019) and cooptation (2020–present).

The concept of regulatory states, neutralisation and cooptation, is central to the study's theoretical framework.

Neutralisation is defined as the central bank’s attempt to ban or delegitimise cryptocurrencies, often by denying them legal status and refusing regulatory oversight. This stance is rooted in the imperative to preserve the exclusivity of fiat currency and the central bank's monopoly over monetary policy.

In contrast, cooptation refers to the central bank's strategic embrace of certain aspects of cryptocurrencies, particularly stablecoins, and integrating their technological innovations into the design of central bank digital currencies (CBDCs). Cooptation is not merely a reactive posture but a proactive strategy aimed at preserving institutional legitimacy and monetary sovereignty in the face of rising public interest in digital assets.

The period of neutralisation (2018–2019) was characterised by the ECB's overt hostility towards cryptocurrencies. In its 2018 statement, the ECB likened the rise of Bitcoin to the Dutch Tulip mania, suggesting that cryptocurrencies were in a speculative bubble destined to "wilt" without value. The ECB dismissed cryptocurrencies as lacking both intrinsic and extrinsic value, debunking comparisons to gold and fiat currencies. Despite this scepticism, the ECB refrained from imposing direct regulatory controls on cryptocurrency creation and firms' operations. This regulatory abstention, coupled with the ECB's market-oriented approach to financial innovation, inadvertently created a permissive environment for the proliferation of cryptocurrencies and payment service providers.

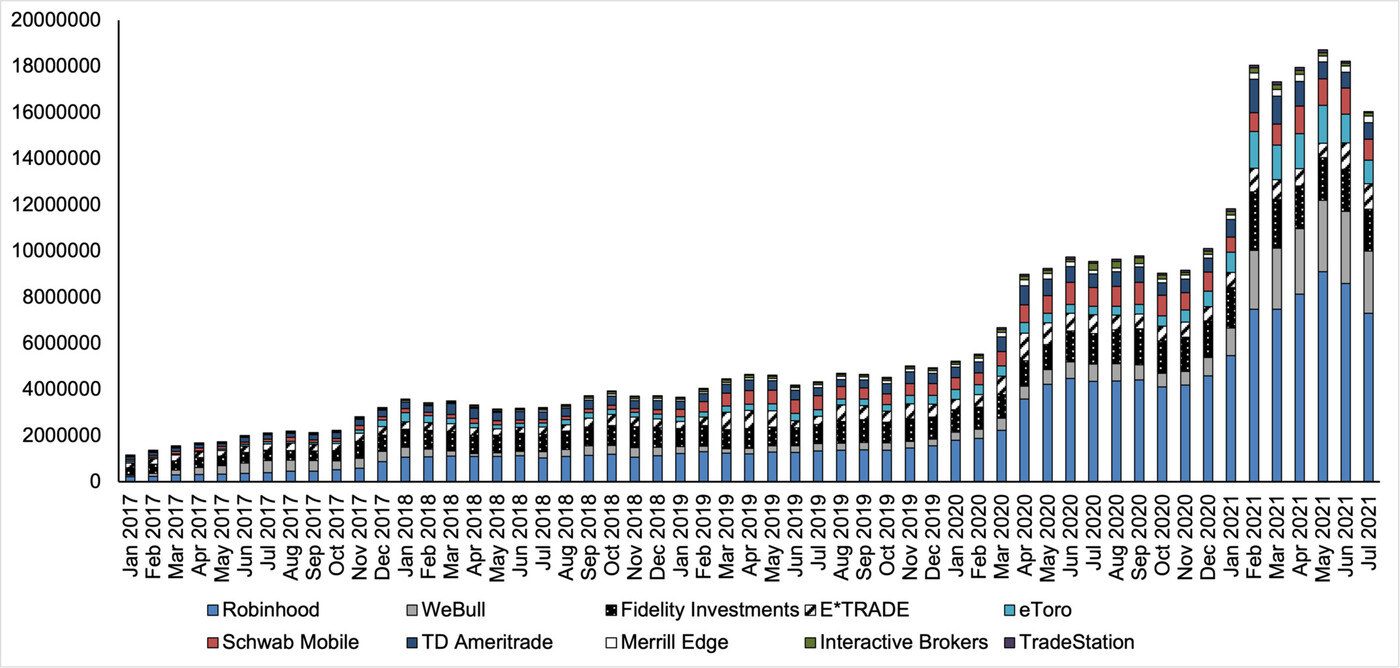

Figure 1. The number of monthly active users in the top 10 trading platforms between January 2017 and July 2021.

A key development during this period was the 2019 relaunch of the Single Euro Payments Area (SEPA) instant credit transfer scheme. Intended to facilitate borderless and instantaneous retail payments within the EU, the SEPA relaunch deregulated payment processors and broadened access to digital platforms, many of which enabled cryptocurrency trading (Figure 1). The inclusion of digital tokens such as cryptocurrencies in the Payment Services Directive (PSD2) further legitimised their role in the payments ecosystem. As a result, the mean aggregate level of cryptocurrency adoption in Europe rose markedly after the SEPA relaunch, with major economies such as Germany and France reporting significant increases in household participation in cryptocurrency markets.

The neutralisation phase thus paradoxically abetted the expansion of cryptocurrencies by relaxing regulatory barriers and fostering innovation in payment systems. Traditional financial institutions and alternative brokerages both seized the opportunity to diversify their product offerings, with firms like JPMorgan and Robinhood launching cryptocurrency funds and integrating digital asset trading into their platforms. The proliferation of trading platforms and the surge in monthly active users underscored the unintended consequences of the ECB's deregulatory stance.

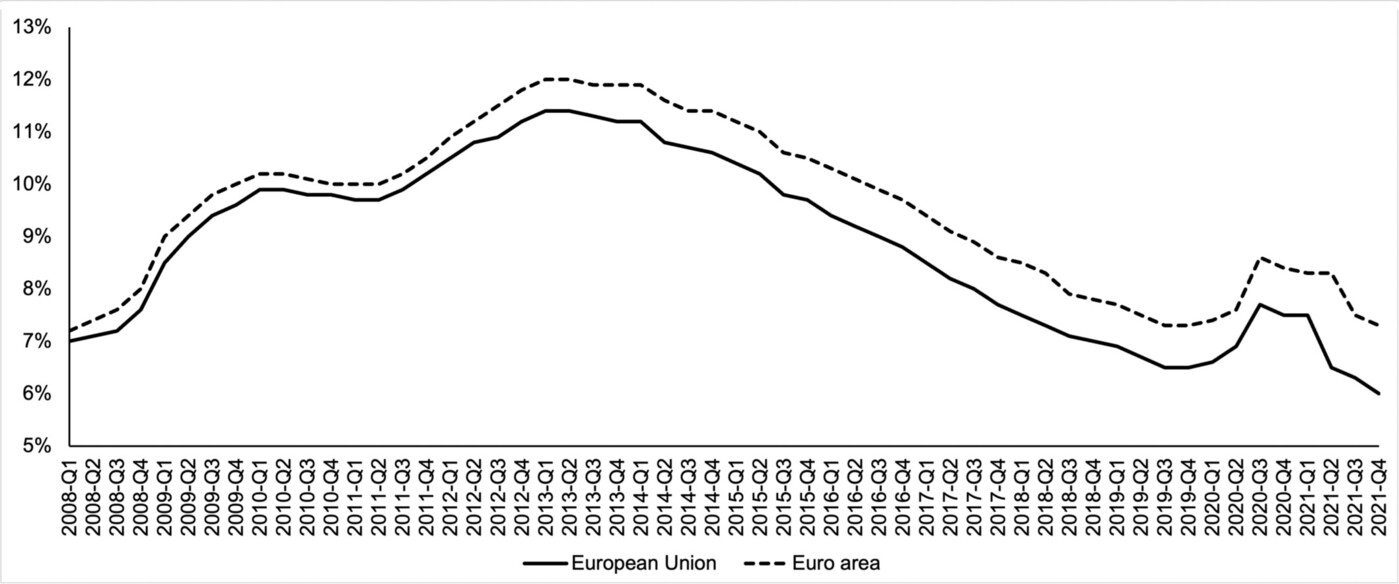

The onset of the COVID-19 pandemic in 2020 marked a turning point in the ECB's regulatory approach, ushering in the era of cooptation. The pandemic precipitated a dual crisis of high unemployment and inflation (Figure 2), exacerbating economic precarity among European households. The ECB's contractionary monetary policy, aimed at taming inflation through interest rate hikes, proved ineffective and further widened inequality. The European Systemic Risk Board issued warnings about financial stability, and inflation rates soared to unprecedented levels, disproportionately affecting poorer households.

Figure 2. The quarterly unemployment rates (top) and the annualised inflation rate (%) (bottom) in Europe from 2008 to 2021.

Amidst this economic turmoil, the appeal of cryptocurrencies as alternative sources of income intensified. The number of monthly active users on cryptocurrency platforms surged, and the share of credit transfers conducted under the SEPA scheme continued to climb. The research demonstrates a positive correlation between inflation rates and cryptocurrency adoption, suggesting that periods of economic instability drive households towards riskier financial assets.

Recognising the limitations of its earlier stance, the ECB began to soften its tone in reference towards cryptocurrencies. In a 2020 address, ECB President Christine Lagarde acknowledged the acceleration of digital payments and the emergence of private digital monies. The ECB conceded that central bank money in digital form was not yet available for retail payments, highlighting a critical gap in its monetary toolkit. This realisation prompted the ECB to explore the development of a digital Euro, a CBDC designed to complement physical cash and enhance cross-border payment efficiency.

The cooptation phase was characterised by the ECB's willingness to learn from and integrate elements of cryptocurrency technology, particularly stablecoins, into the design of the digital Euro. Stablecoins, pegged to conventional assets at fixed exchange rates, were recognised for their potential to facilitate efficient ledger systems and payment services. The ECB's reports and policy statements began to frame stablecoins as models for the digital Euro, emphasising the need for sound regulation and public backing to mitigate risks such as liquidity runs and contagion.

The ECB's collaboration with the European Securities and Markets Authority on the Markets in Crypto-Assets Regulation (MiCA) exemplified this shift. While MiCA aimed to close regulatory gaps, it granted cryptocurrency firms considerable autonomy in risk management, focusing primarily on transparency rather than stringent oversight. The ECB's evaluation of the PSD2 further signalled its intention to liberalise payment systems and promote open banking, drawing inspiration from blockchain technologies underpinning cryptocurrencies.

Open banking, facilitated by decentralised ledger technologies and application programming interfaces, became a focal point of the ECB’s strategy to modernise the European payments landscape. The architecture of blockchain networks was recognised for its ability to satisfy both open banking requirements and stringent data protection laws such as the General Data Protection Regulation. By removing obstacles to open banking and consumer control over data access, the ECB positioned itself as a champion of financial innovation while preserving its regulatory prerogatives.

The cooptation phase also reflected the ECB's response to global forces and competitive pressures. The regulatory experiences of counterpart agencies such as the US Securities and Exchange Commission (SEC) served as cautionary tales. The SEC's aggressive clampdowns on cryptocurrency firms were met with legal setbacks and political resistance, culminating in the passage of the Financial Innovation and Technology for the 21st Century Act, which clarified regulatory jurisdiction and diminished enforcement risk for digital asset platforms. The ECB observed these developments and opted to classify cryptocurrencies as financial assets rather than currencies, thereby permitting their integration into existing payment channels without ceding monetary sovereignty.

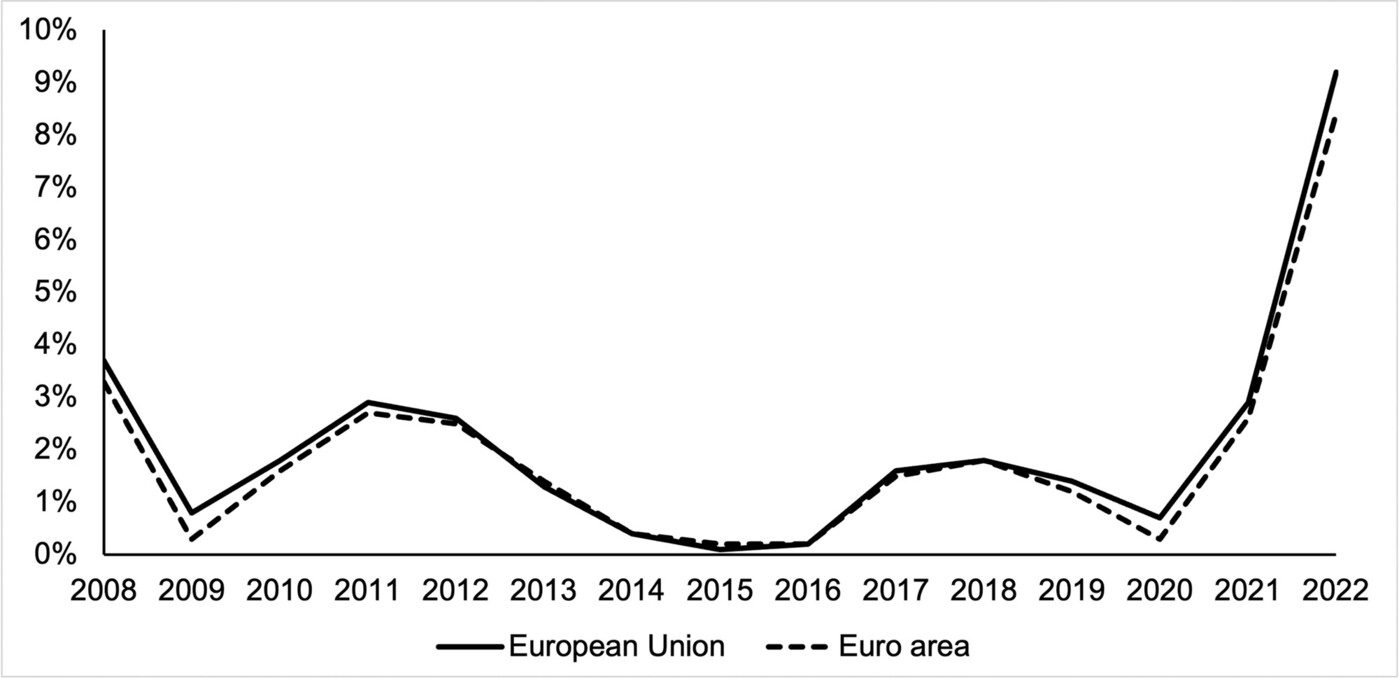

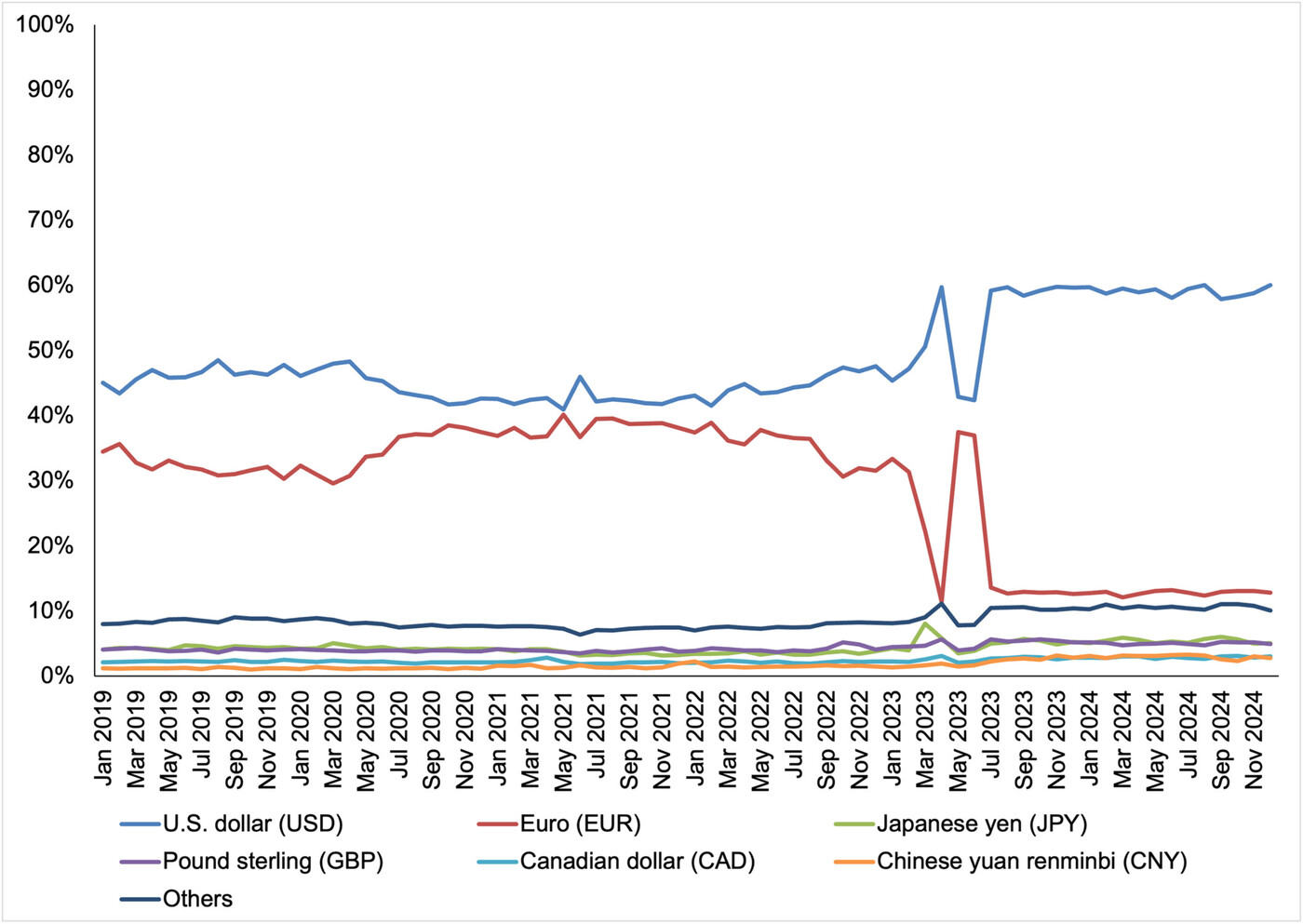

The decline of the Euro as a proportion of international payments, exacerbated by geopolitical instability and the rise of competing CBDCs such as the digital Dollar and China's eRMB, further motivated the ECB's digitalisation initiatives (Figure 3). The digital Euro was envisioned as a means to defend the currency's competitive position, enhance convenience yields and counter the encroachment of Big Tech firms into the payments space. The ECB's pivot towards cooptation was thus both a defensive and innovative response to the fragmenting landscape of global digital payments.

Figure 3. Major currencies as a proportion of SWIFT payments from 2019 to 2024.

In conclusion, the study provides a nuanced account of the ECB's evolving regulatory stance towards cryptocurrencies, tracing its journey from neutralisation to cooptation. It highlights the complex interplay between macroeconomic pressures, global regulatory developments and technological innovation in shaping central bank policy. By moving from hostility to strategic embrace, the ECB has demonstrated a capacity for institutional adaptation, leveraging the very technologies it once sought to neutralise to preserve its legitimacy and monetary sovereignty. The implications for FinTech academia are profound, offering insights into the dynamics of regulatory change, the role of financial asset classifications and the future of digital currencies in an increasingly interconnected financial system.

Prof. Au has published over 50 peer-reviewed journal articles on firms and markets, digitalisation, economic sociology and social networks. He received the Biennial Best Article Award (Honorary Mention) from The Sociological Quarterly in 2019 and the A. Noam Chomsky Rising Star Emerging Scholar Award from the Society of Transnational Academic Researchers in 2021. He has also secured more than HKD3 million in research funding.

| References |

|---|

[1] Au, A. (2025). Evolutions in the European Central Bank's Regulatory Stance Toward Cryptocurrencies: From Neutralization to Cooptation. Policy & Internet, 2025; 17:e70002 1 of 19. https://doi.org/10.1002/poi3.70002.

[2] Berwick, A., & Wilson, T. (2022). Exclusive: Behind FTX's Fall, Battling Billionaires and a Failed Bid to Save Crypto. Reuters. https://www.reuters.com/technology/exclusive-behind-ftxs-fall-battlingbillionaires-failed-bid-save-crypto-2022-11-10/.

[3] Lawder, D. (2022). U.S. Treasury's Yellen Says Cryptocurrencies Need Regulation. Reuters (December 1, 2022). https://www.reuters.com/technology/us-treasurys-yellen-says-cryptocurrencies-need-regulation-2022-11-30/.

| Prof. Anson Cheuk Ho AU Assistant Professor, Department of Applied Social Sciences |