Rethinking Retail Refunds: The Blockchain Advantage

Other Articles

How Stablecoins and Traceability Reshape Retailer Strategies

Study conducted by Prof. Nick Sai Ho CHUNG and his research team

The retail sector is undergoing a profound transformation as blockchain technology and cryptocurrencies become increasingly integrated into everyday operations. From luxury fashion houses like Gucci to global e-commerce platforms such as Farfetch, retailers are experimenting with accepting cryptocurrencies as payment and leveraging blockchain’s traceability features to enhance transparency and consumer trust. These innovations promise to reduce payment friction, lower transaction costs and provide consumers with unprecedented access to product information. Yet, the adoption of blockchain in retail introduces new complexities, particularly in markets where product returns are prevalent and consumer risk aversion is high.

Writing in the European Journal of Operational Research [1], Prof. Nick Sai Ho CHUNG, Associate Head and Associate Professor of the Department of Industrial and Systems Engineering at The Hong Kong Polytechnic University, and his team have presented a summary and analysis of a recent research study that analytically investigates the dual role of blockchain in retail operations: facilitating stablecoin payments and enabling traceability. The study develops a rigorous model to examine how these blockchain functions affect retailer profitability, consumer surplus and social welfare, with a particular focus on the economics of refunds and returns.

While blockchain's potential to streamline payments and enhance supply chain transparency is well recognised, its impact on retail operations, especially in the context of product returns and consumer risk aversion, remains underexplored. This study provides the first analytical framework to jointly examine stablecoin payments and blockchain-enabled traceability in retail, focusing on their combined effects on pricing, refund strategies and welfare outcomes.

The Model

The study considers a monopolistic retailer selling a product to a continuum of consumers, each of whom faces uncertainty regarding their valuation of the product prior to purchase. The retailer must decide whether to adopt blockchain technology which entails two key features: accepting stablecoin payments and providing traceability information via blockchain.

Without blockchain adoption (the NB, or "No Blockchain", strategy), transactions are processed via traditional payment methods such as credit cards, which incur a processing fee. Consumers only discover their true product valuation after purchase, and may return the product for a partial refund. The retailer’s profit is affected by the processing fee and the salvage value of returned goods.

With blockchain adoption (the BC, or "Blockchain", strategy), the retailer accepts stablecoins, cryptocurrencies pegged to fiat currencies and designed to minimise volatility. However, empirical evidence shows that even stablecoins can exhibit short-term price fluctuations, which introduces risk for consumers, particularly when refunds are issued in the original cryptocurrency. Blockchain traceability allows the retailer to disclose product information, enabling some consumers to resolve their valuation uncertainty before purchase and thus reducing the likelihood of returns.

The model divides consumers into two segments: "searchers", who can costlessly obtain and process blockchain information to determine their true valuation ex ante, and "non-searchers", who cannot or do not access this information and thus face valuation uncertainty. The proportion of searchers is denoted by α, representing the information disclosure level.

It also introduces a "volatility discount" parameter β, which captures the extent to which consumers discount refunds due to risk aversion and stablecoin price volatility. A higher β indicates lower sensitivity to volatility (i.e., less risk-averse consumers or higher stability of stablecoins).

The retailer's decision variables are the selling price p and the refund amount r. The restocking fee is p – r. The retailer’s objective is to maximise expected profit, taking into account the behaviour of both searchers and non-searchers, the costs of payment processing, and the salvage value of returns.

Model Analysis: Refunds, Profits and Strategic Comparisons

A central insight of the study is how blockchain adoption fundamentally alters the retailer's optimal refund strategy. In the traditional NB model, the retailer sets a partial refund equal to the sum of the credit card processing fee and the salvage value of the returned product. This strategy allows the retailer to extract surplus from low-valuation consumers who return products, while still attracting high-valuation consumers to purchase.

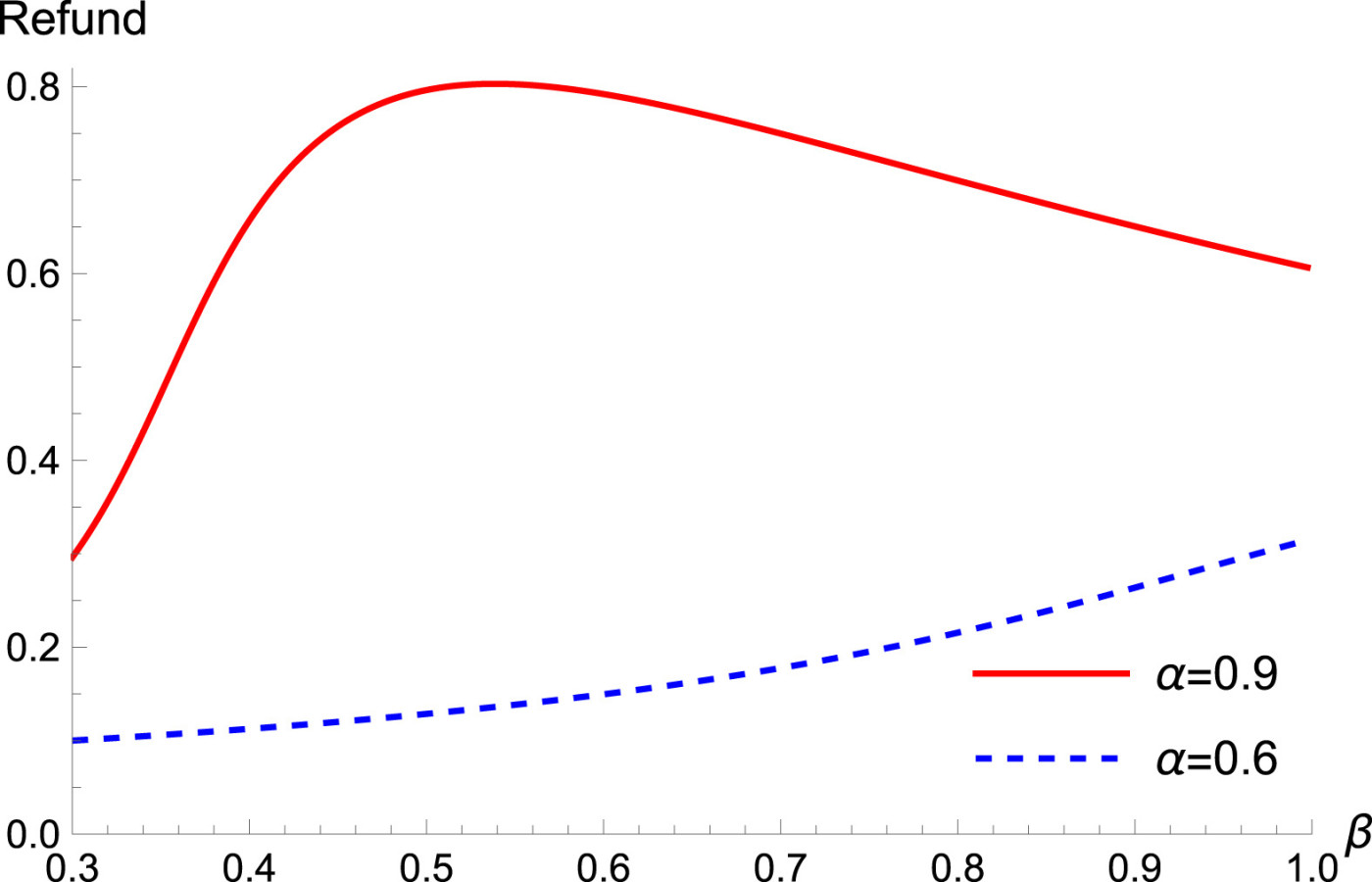

Figure 1. The optimal refund in the BC model.

In the BC model, the optimal refund is shaped by both the information disclosure level α and the volatility discount β (Figure 1). When α is large and β is small, the retailer may offer a generous refund. This counterintuitive result arises because a generous refund can attract non-searchers despite the risk of price volatility, while the retailer can still extract surplus from informed, high-valuation consumers through higher prices.

Conversely, when information disclosure is low (α is small), the retailer tends to offer an ungenerous refund, as most consumers are non-searchers and the risk of returns is higher. Notably, the optimal refund in the BC model can be lower than the salvage value of the product. This is because risk-averse consumers perceive refunds in volatile stablecoins as less valuable, allowing the retailer to reduce the refund amount without losing demand.

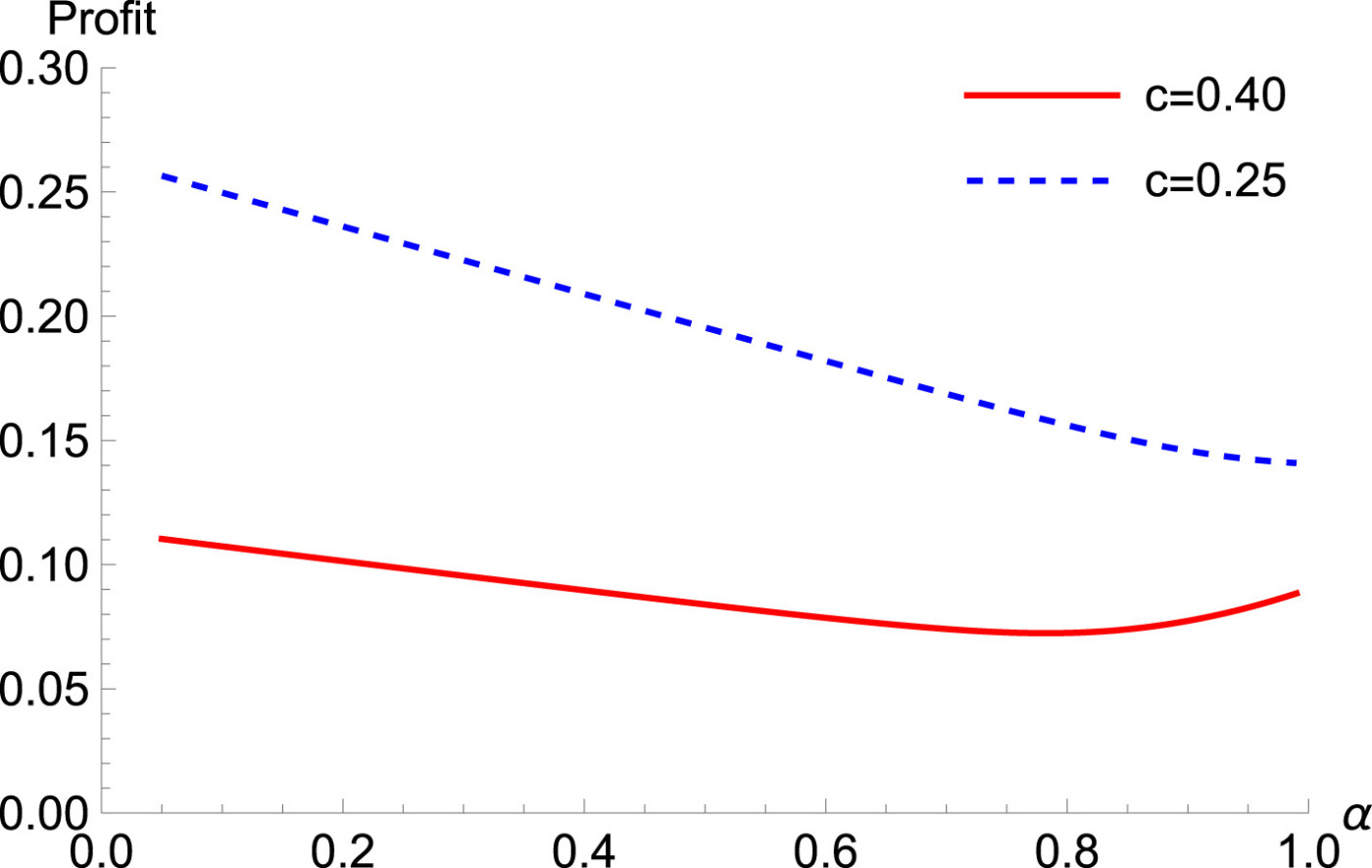

Figure 2. The retailer's profit in the BC model. c denotes the cost of the good.

The retailer's profit under blockchain adoption exhibits a U-shaped relationship with the information disclosure level (Figure 2). When α is very small or very large, blockchain adoption can increase retailer's profit. At small α, the main benefit comes from improved salvage value due to traceability; while at large α, the retailer can charge higher prices to informed consumers and reduce returns. However, at intermediate levels of α, blockchain adoption may reduce profit, as too many low-valuation consumers exit the market and the retailer cannot fully exploit high-valuation consumers.

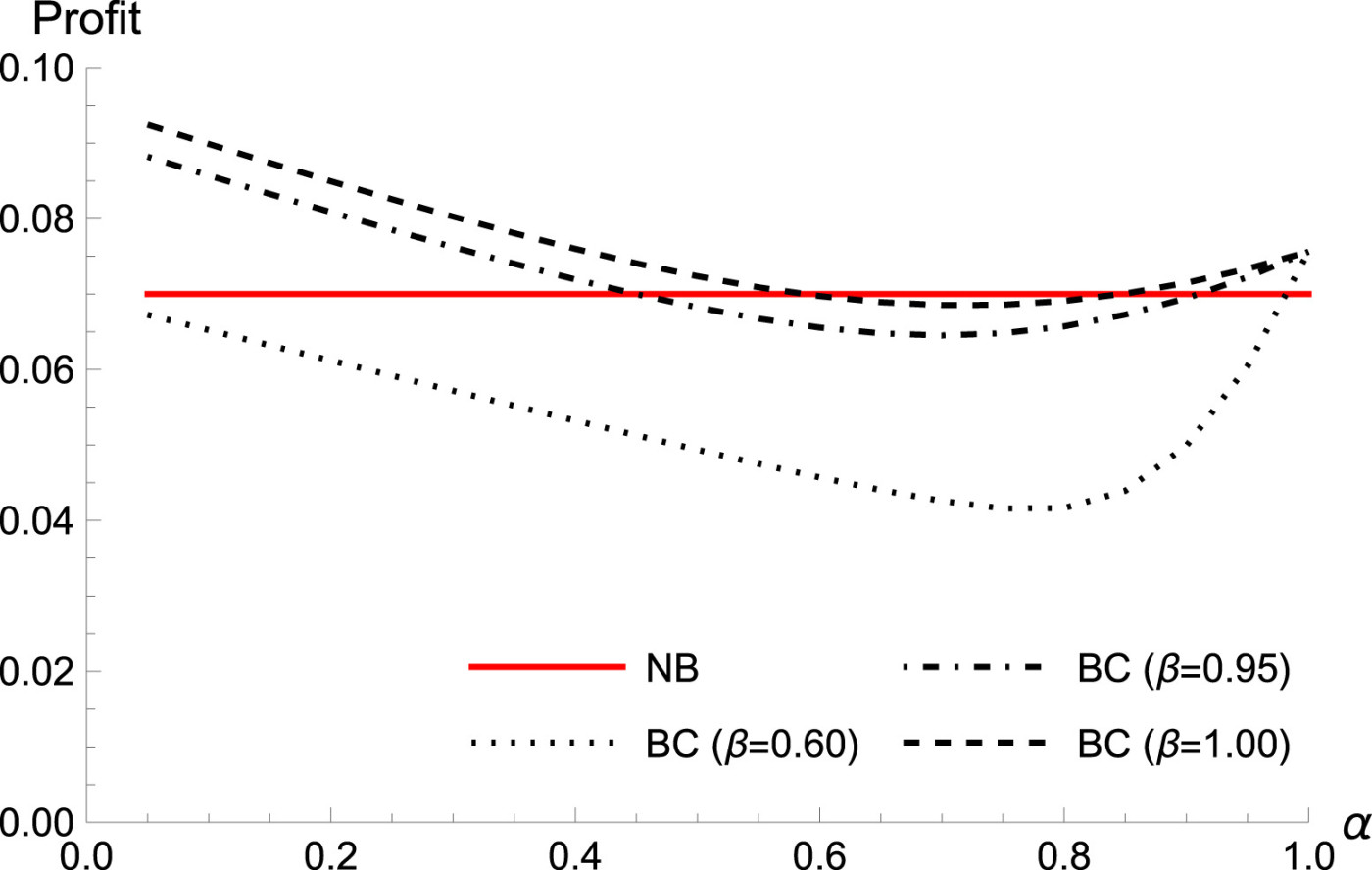

Figure 3. Profit comparison between NC and BC models.

The volatility discount β also plays a crucial role (Figure 3). As β increases (i.e., stablecoins become more stable or consumers are less risk-averse), the retailer can raise prices and increase profit. Paradoxically, this comes at the expense of consumer surplus: higher stablecoin stability enables the retailer to extract more surplus from consumers, leaving them worse off.

Comparing the NB and BC models, the study finds that blockchain adoption can create a win-win outcome for both retailer and consumers, but only under certain conditions. If the processing fee for traditional payments is high, or if the information disclosure level is polarised, blockchain adoption is likely to benefit the retailer. For consumers, blockchain adoption always increases total surplus compared to the NB strategy, as it enables some consumers to make better-informed decisions and avoid returns. However, the benefit to consumers diminishes if information is oversupplied, as higher prices can offset the value of additional information.

Social welfare, defined as the sum of retailer profit and consumer surplus, is not always maximised under the retailer's optimal blockchain strategy. The retailer’s profit-maximising price-refund pair typically exceeds the welfare-maximising levels, leading to welfare losses relative to the social optimum.

Model Extensions

The study explores several extensions to test the robustness of its findings. First, it considers a flexible payment policy, allowing consumers to choose between credit cards and stablecoins. While this can benefit the retailer, it may reduce consumer surplus in some scenarios, particularly when both payment methods are inexpensive.

Second, the impact of a mandatory full refund policy is analysed. Contrary to conventional wisdom, mandating full refunds in blockchain-enabled retail can result in a lose-lose outcome, because the retailer is forced to raise prices to offset the risk of returns, especially when refunds are issued in volatile stablecoins.

Third, the model is extended to account for retailer risk aversion to stablecoin volatility. When the retailer is highly risk-averse relative to consumers, higher stablecoin stability can actually benefit consumers, reversing the main result of the baseline model.

Fourth, the information disclosure level is endogenised by allowing consumers to choose whether to search for blockchain information based on their individual search costs. It is found that blockchain adoption can benefit both retailer and consumers, but the distribution of surplus depends on the interplay between information costs, price volatility and refund policy.

Finally, the model incorporates uncertainty about product matches, which blockchain traceability cannot resolve. The analysis shows that blockchain adoption is especially valuable in markets with high product mismatch rates, as it enables better targeting of informed consumers and reduces costly returns.

This study provides the first comprehensive analytical framework for understanding the impact of blockchain adoption on retail operations, with a focus on stablecoin payments and traceability. The findings challenge several conventional assumptions: greater stablecoin stability does not necessarily benefit consumers, and more information disclosure is not always better. Instead, the optimal strategy for retailers depends on the interplay between information disclosure, price volatility and consumer behaviour.

Blockchain adoption can create a win-win outcome for retailers and consumers, but only under specific market conditions. Retailers must carefully calibrate their pricing and refund strategies to balance the benefits of traceability and payment efficiency against the risks of consumer exit and surplus extraction.

Prof. Chung has published over 150 SCI journal papers in international journals. He was recognised by Stanford University as one of the top 2% most-cited scientists worldwide (career-long) in the field of engineering for two consecutive years, from 2024 to 2025, and one of the top 2% most-cited scientists worldwide (single-year) for four consecutive years, from 2022 to 2025). He has obtained two patents and has attracted total research funding of over HKD15 million.

| References |

|---|

[1] Zhang, K., Choi, T. M., Chung, S. H., Dai, Y. & Wen, X. (2024). Blockchain adoption in retail operations: Stablecoins and traceability, European Journal of Operational Research, Volume 315, Issue 1, 2024, Pages 147-160, ISSN 0377-2217, https://doi.org/10.1016/j.ejor.2023.11.026.

| Prof. Nick Sai Ho CHUNG Associate Head and Associate Professor, |